Past Events

The Schwartz Center for Economic Policy Analysis (SCEPA) hosts public events to share our peer-reviewed research and policy findings with policymakers, advocates, and the broader community. As the policy research arm of The New School’s heterodox economics department, our events provide alternative perspectives on today’s most pressing economic issues.

-

Our signature seminar series includes:

The Schwartz Lecture – An annual event featuring high-profile economic thinkers and policymakers who challenge conventional narratives and inspire new approaches to economic policy. Past speakers include Thomas Piketty, Heather Boushey, and Robert Solow.

The Heilbroner Lecture – Named in honor of Robert Heilbroner, this lecture explores the intersection of capitalism, justice, and the public good. Notable past speakers include Angus Deaton, Yanis Varoufakis, and Bina Agarwal.

The Political Economy of Aging (PEoA) Seminar Series – A research-focused series that convenes scholars to examine retirement security and the labor market challenges facing older workers, featuring speakers from leading universities, global institutions, and public agencies.

Explore upcoming and past events below to join the conversation and engage with cutting-edge economic research.

2025 Heilbroner Lecture with Jayati Ghosh: Power, Control, and Democracy in the 21st Century

Dr. Jayati Ghosh will deliver the annual Robert Heilbroner Memorial Lecture at The New School with an ambitious and critical analysis that honors Heilbroner’s own breadth and depth: Power, Control, and Democracy in the 21st Century.

NSSR Economics Seminars with Brent Haddad: Rapid Evolution of Water Law in Response to Climate Change

Brent Haddad, Professor of Environmental Studies at the University of California, Santa Cruz will present his talk, "Rapid Evolution of Water Law in Response to Climate Change."

Reimagining Work, Wealth and Aging: Teresa Ghilarducci's Impact on Economics and Policy

Organized by former PhD students, Reimagining Work, Wealth, and Aging: Teresa Ghilarducci’s Impact on Economics and Policy will showcase Professor Ghilarducci's contributions to building the field of economics.

Central Banks and Climate Change: the Challenge is Now

Professor Willi Semmler delivered the keynote speech on sustainable macroeconomics, climate risks, and energy transitions at the Central Banks and Climate Change event hosted by the University of Rome and the Centro Europa Ricerche.

Welcome Address

Giovanni Di Bartolomeo – Sapienza University of Rome

Chairmen

Dario Aversa – University of Palermo

Giovanni Ferri – Comitato Scientifico CER - Centro Europa Ricerche

Session Chair:

Andrea Pira – Huffington Post

Speakers

Mauro Gallegati – Polytechnical University of the Marche

Riccardo Puglisi – University of Pavia

Marco Siino – University of Bologna

Marco Valente – University of l’Aquila

(1.5 MB)

NSSR Economics Seminars with Harry Holzer: Why Doesn't the US Labor Market Produce More Good Jobs?

Harry Holzer, the John LaFarge Jr. Professor of Public Policy at Georgetown University presented his talk, "Why Doesn't the US Labor Market Produce More Good Jobs?" He will discuss definitions of "good jobs" and evidence on these definitions; their importance in accounting for recent trends in labor market inequality; why private labor markets underproduce such quality, even if the labor market is competitive (and "good jobs" can be profitable for employers); and potential policy approaches.

2023 Heilbroner Lecture with Ellora Derenoncourt: The Evolution of Racial Inequality in the United States

Dr. Ellora Derenoncourt will deliver the Heilbroner Lecture on the evolution of racial inequality in the United States, its consequences, and its historical determinants.

Wealth and Inequality: What Can the Federal Reserve Do?

Schwartz Lecture by Atlanta Fed President Raphael Bostic Provokes Rich Dialogue | In these times of broadening precarity, how can Americans build wealth, economic mobility, and security as they grow older? What can policymakers do to give financially fragile aging Americans a fighting chance, and build greater economic equality? This crucial question was the focus of this year’s Schwartz Lecture, by Dr. Raphael Bostic, president of the Federal Reserve Bank of Atlanta.

Serving as president and CEO of the Atlanta Fed since 2017 (he also worked as an economist for the Fed from 1995-2001), Dr. Bostic has written widely on the need for economic and racial equity. While the Fed’s primary mission is “to pursue price stability and maximum employment,” Bostic said, he interprets the goal as “sustained maximum employment”—what he called “a more inclusive objective.” (You can read the full transcript of Dr. Bostic’s speech here.)

Reflecting on the goal of “maximum employment” and Federal Reserve Bank policies, Dr. Bostic told The Washington Post in 2022, “one of the things that we've learned over the last, really, 10 years or so is that the Federal Reserve was a little too aggressive in slowing growth as we got closer to maximum employment, and there was as risk that maybe we were preventing the economy from including people in terms of employment that we might have otherwise.”

As Professor Teresa Ghilarducci of the New School laid out in opening remarks, the long-term trajectory of economic equality in wealth-building is not promising: median household wealth for Americans over 50 is down; Social Security benefits are down; and retirement benefits are, on average, in worse shape than they were in 1992.

Despite these grim trends, Dr. Bostic pointed to some hopeful progress in recent decades, particularly before the COVID-19 pandemic. In the late 2010s, preceding pandemic, Black and Hispanic unemployment reached all-time lows, and their disparities with white unemployment decreased, according to Dr. Bostic. In this same period, Black workers made significant economic gains. Also promising were gains in educational attainment for Black and Hispanic workers, “far outpacing” overall rates between 2010 and 2020. This progress was soon stifled by the tidal wave of COVID-19, which reversed many of these gains and hit Black and Hispanic communities especially hard.

Building Economic Mobility and Resilience

Toward the larger aim of building “economic mobility and resilience,” Dr. Bostic stressed the importance of creating maximum sustainable employment as a primary path to reducing America’s widening wealth inequality. Monetary policy, while constrained in its role, can help prod toward that “inclusive objective” of creating “gainful employment in a job that is consistent with their full potential,” Dr. Bostic noted.

While constrained in its mandate, the Federal Reserve Bank connects with other policymakers to find workable solutions that increase economic mobility and resilience in the communities they serve, Dr. Bostic said. But since many of the ideas and solutions needed are beyond the authority of the central bank and monetary policy, Dr. Bostic challenged other policymakers and leaders to collectively step up to find effective and lasting solutions that reduce wealth inequality in this and future generations.

One example Dr. Bostic described from his region: with assistance from the Federal Reserve Bank of Atlanta’s “Advancing Careers” team, a bi-partisan initiative in Florida helps address the “benefits cliff” that can discourage many poor people from moving from public aid to more gainful employment. These benefits cliffs cut aid when recipients earn money, often creating a treadmill that keeps people poor instead of building assets to climb out of poverty.

In this initiative, recipients in Florida’s children's health insurance program (CHIP) can earn more while keeping their benefits so they can build self-sufficiency, “tiding people over while they get better off,” Dr. Bostic described. The Florida initiative, he said, “demonstrates that, even in today's hyper-charged political environment, policies to mitigate benefits cliffs are achievable and, in some cases, uncontroversial.”

The Atlanta Fed “did not lobby for this policy shift,” Dr. Bostic pointed out. “Rather, our tool allowed policy makers to get objective information that informed their thinking about the issue and ultimately led them to pursue a policy change.”

Big Structural Challenges

Despite such promising initiatives and some hopeful short-term trends prior to the pandemic, longer-term structural challenges are posing big obstacles to progress in economic equality, wealth-building, and resilience.

For the bottom 90% of households nearing retirement, wealth has declined since 1992, according to a forthcoming research paper by SCEPA director Teresa Ghilarducci, research associate Jessica Forden, and former associate director Siavash Radpour, now assistant professor of economics at Stockton University. In fact, they found, the only source of wealth helping this group is Social Security.

Even with policies and tax breaks to promote more savings, SCEPA’s team found, the share of the bottom 50 percent having any retirement account barely budged in 20 years: 46 percent in 1992 and 47 percent in 2016. The middle class—the next 40 percent in the economy—suffered in this same period, with the portion holding retirement savings sinking from 85 percent to a low of 71 percent.

Analyzing 20 years of data, the SCEPA researchers observed that “the bulk of working-class wealth is government social insurance.” Outside of Social Security, most wealth-building institutions in the U.S, they concluded, “are failing the typical American.” For most Americans who are nearing retirement age, wealth “primarily comes from social insurance—Social Security—not stocks and bonds held in retirement accounts and not, contrary to popular opinion, home equity.”

Confronting Obstacles

In his closing remarks, Dr. Bostic acknowledged, “a consensus around the best ways to address disparities remains elusive.” Inequality in America, he stressed, “has been well over a century in the making. It won't dissipate quickly. There is much to do, and much can go wrong. But I'm optimistic because we're having the right conversations, smart people are doing important research and practical work, and there is a real appetite for change.”

Alluding to the scholarly crowd, he added, “researchers like you have a vital role to play in marshaling evidence so that policy is informed by sound information rather than stubborn misconceptions.”

After Dr. Bostic’s talk, a panel of these scholars weighed in. On the matter of wealth inequality, Professor Ghilarducci asked, “is the Fed doing enough?”

“No,” responded Darrick Hamilton, founding director of the Institute on Race, Power and Political Economy at the New School. Reflecting on Dr. Bostic’s earlier remarks on inflation and inclusion, Hamilton added, “the Fed is not doing enough,” and its focus on inflation “is overemphasized at the expense of ensuring there is greater inclusion in the economy.” Beyond basic employment, said Hamilton, “there needs to be an emphasis on good jobs.” The Fed, as “the people’s bank and the bank of banks,” can help prod “distributionally better outcomes,” he argued.

Panelist Tony James, co-founder of the Partnership for Education Advancement, offered a different view: “I’m all for the Fed erring on the side of jobs,” he said, but is sensitive to the idea that “inflation is more painful than you know for people at the low end of the income scale.” James contended that recent analysis by the Fed suggest that income rises from the 2010s are now gradually being reflected in wealth shifts.

Meanwhile, labor economist Kate Bahn, research director of the Urban Institute’s WorkRise, noted it is “huge” and “major” that the Fed is “recognizing that wealth inequality is bad for the economy.” In the labor market, this inequality “is not some incentive for people to work harder and to move up,” Bahn said. “It’s actually a constraint and a barrier to people being able to do that.” Beyond maximum sustained employment, Bahn emphasized the importance of worker mobility and job quality. “There is evidence that unions result in wealth-building power, particularly for workers from marginalized groups,” she said. “The ability for workers to exercise rights … [and] to be protected against retaliation through unions is huge. It changes the dynamics of how the economy functions.”

Research Workshop: Meeting the Challenges of Climate Change

December 2, 2023

Low-income and lower-middle-income economies are responsible for only a small portion of global carbon emissions, but they bear a disproportionate burden of the adverse effects of climate change. These countries are faced with numerous challenges to their efforts to mitigate carbon emissions. There is a considerable disparity in the availability of knowledge and technologies that are crucial for both mitigation of and adaptation to climate risks, and advanced economies, aiming to protect private sector interests, are reluctant to promote technological transfer. There is also a lack of funding and capital flows necessary for climate adaptation and the transition to a low-carbon economy. Furthermore, sovereign debt heavily constrains low and middle-income countries from using debt or bond financing for climate change challenges.

This workshop had the goal of creating a better understanding of — and possible solutions for — the challenges faced by low- and middle-income economies due to climate change.

This workshop focused on the following themes:

Gaining a better understanding of how various macroeconomic factors are related to the production of CO2 emissions.

Identifying the types of climate disasters and damages that can be expected to occur in certain regions and countries. This will inform region-specific consequences of climate change, such as water scarcity, diminished agricultural yield, increased frequency of extreme weather events, and lower economic growth. All these factors contribute to additional challenges such as mass migration, heightened geopolitical tensions, and an increased wealth gap between high- and low-income economies.

Low- and middle-income economies are faced with a trade-off between economic growth, which still mostly relies on fossil-fuel use, and lower emissions. We discussed the tradeoffs between climate protection and economic growth.

What role can various sectors play in adapting to and mitigating the impacts of climate change? What are the private sector dynamics concerning new renewable energy technologies? Can the financial sector be of help in funding the transition to low-carbon economies? Does high indebtedness and other economic indicators hamper the flow of funds (given higher perceived risks)? Can there be a stronger role for the public sector, for example with climate-related infrastructure investments and fiscal/monetary policy? Finally, what are the distributional impacts of climate policies?

Agenda

Session 1 | Challenges of Climate Change in Africa

Moderator: Ibrahim Tahri (PIK, Potsdam)

Jose Neves and João Braga: Climate Challenges in Africa and Latin America

Marieme Toure: Climate Change Impact on Agricultural Production and Food Security in Sub-Saharan Africa - Evidence from Senegal

Session 2 | Challenges of Climate Change and Migration

Moderator: Alex Aleinikoff

Alex Aleinikoff: Some remarks on global norms and institutions concerning climate-related migration

Albano Rikani: More people too poor to move: divergent effects of climate change on global migration patterns

Achilles Kallergis: Urban Dimensions of Environmental Mobility: Evidence from African Cities

Plenary Speaker | Dr. Nicoletta Batini (IMF): Climate Risks and Sustainable Agriculture

Session 4 | Climate Change and Green Transition

Moderator: Ibrahim Tahri (PIK, Potsdam)

Ettore Gallo: Green Investment and Productivity: Main Policy Challenges in the EU Presentation

Julia Puaschunder: Bringing Nature into Economics: Natural Resources and Climate Wealth of Nations in National and International Accounting

Nataliaa Bychkova: ESG Concerns in Ukraine Reconstruction

Session 5 | Macroeconomics of Climate Change

Moderators: Willi Semmler and Samuel Owusu

Feridoon Koohi-Kamali: Modeling the Global Macroeconomic. Effects of Carbon Tax on Transition to Low CO2 Presentation

Oriol Valles Codina: Business Cycles, Sectoral Price Stabilization, and Climate Change Mitigation: a Model of Multi-Sector Growth in the Tradition of the Bielefeld Disequilibrium Approach

Samuel Owusu: The relationship between CO2 emissions, renewable and fossil fuel consumption, FDI, economic growth, import and energy intensity: Evidence from the top three production-based CO2 emissions in Africa in 2022

Session 6 | Green Transition Challenges at the Firm and Individual Level

Moderator: Samuel Owusu

Behnaz Minooei Fard, University of Venice: Energy Transition and Rare Earth Resource Constraints: Market Dynamics in an Asymmetric Duopoly Model Presentation

Tato Khundadze: Consumo Ergo Sum’: Endogenous Evolution of Preferences and Complex Economic Dynamics

Ibrahim Tahri: Public Infrastructure Delays and Transition Risks

Part One | Sessions 1-4

Part Two | Sessions 5&6

Macroeconomics for a Warming Planet

What kind of macroeconomics is needed to address the challenge of climate change? That’s the question at the center of this edition of Smart Talk with New School Economics Professor, Willi Semmler. His latest book, co-authored with Unurjargal Nyambuu, "Sustainable Macroeconomics - Climate Risks and Energy Transitions" yields many solutions that he shares in this interview.

2023 Schwartz Lecture with Dr. Raphael Bostic: Work and Wealth Inequality: Policy Responses and Causes

Dr. Raphael Bostic, President and CEO of the Federal Reserve Bank of Atlanta, will deliver the 2023 Schwartz Lecture.

No Way Out

Workers who are 55 and older are increasingly forced to endure onerous, even dangerous jobs that do not provide the pay and benefits needed to allow them to retire. The Economic Policy Institute and the Schwartz Center for Economic Policy Analysis hosted a virtual event that shined a light on this problem and outlined policy recommendations that would alleviate the plight of older workers. The panel featured a discussion of the findings of SCEPA and EPI’s joint chartbook on older workers and retirement.

Who:

- Rep. Don Beyer, Congressman, Virginia’s 8th District

- Siavash Radpour, Associate Research Director, ReLab at the Schwartz Center for Economic Policy Analysis

- Monique Morrisey, Economist, Economic Policy Institute

- Moderator: Teresa Ghilarducci, Bernard L. and Irene Schwartz Professor of Economics and Director, Schwartz Center for Economic Policy Analysis

Book Talk | Unequal Cities

In Person

Cities are central to prosperity: they are hubs of innovation and growth. However, the economic vitality of wealthy cities is marred by persistent and pervasive inequality—and deeply entrenched anti-urban policies and politics limit the options to address it. Structural racism, suburban subsidies, regional government fragmentation, the hostility of state legislatures, and federal policy all contribute to an unequal status quo that underfunds cities while preventing them from pursuing fairer outcomes.

Antitrust Policy and Workers

In Person | Online

March 30, 2023

The Schwartz Center for Economic Policy Analysis and the Communications Workers of America hosted a conference examining the stakes of antitrust policy for workers.

With rising economic inequality and pandemic pressures instigating a wave of worker organizing, we stand at a crossroads where policymakers must ask how they will rein in the power of corporations and concentrated wealth or face even greater immiseration and rebellion. While the Biden administration and antitrust regulators seek to include labor market concerns and workers rights in their evaluation of competition policy, major questions have emerged about what policies make antitrust enforcement “pro-worker.” This conference explored the false dichotomies between "workers" and "consumers" and policies that promote democratic market governance.

Participants were challenged to articulate an antitrust agenda consistent with building a more inclusive economy. How should mergers be reviewed to ensure fair market functioning, not just lower prices? How must major corporations be held accountable for unfair methods of competition embodied in employment misclassification, fissuring of the workplace, and domination of small businesses? What role can the government play in devising new industrial governance structures that bring together capital and labor to negotiate fair terms of competition?

Download the conference paper here.

Session videos can be found here (sign-up necessary).

Schedule

8:45am | Opening | CWA Secretary-Treasurer Sara Steffens and SCEPA Director Teresa Ghilarducci

- Moderator: Marka Peterson, Legal Director, Strategic Organizing Center

- Kate Bahn, Director of Labor Policy & Chief Economist, Washington Center for Equitable Growth

- Andrew Carl, Video game designer and CWA union organizer

- Tamara Paremoer, Divisional Manager of Mergers and Acquisitions, Competition Commission of South Africa

- Marshall Steinbaum, Assistant Professor of Economics, University of Utah

10:00 - 10:30am | Breakout Sessions

11:00 - 11:55am | Employer Strategies of Fissuring and Unfair/Unproductive Competition

- Moderator: Lenore Palladino, Assistant Professor of Economics & Public Policy, University of Massachusetts, Amherst

- Willie Burden, Staff Attorney, International Brotherhood of Teamsters

- Brian Callaci, Chief Economist, Open Markets Institute

- Rachel Dempsey, Attorney, Towards Justice

- Michelle Healy, SEIU Deputy Organizing Director

- Larry Mishel, Former President, Economic Policy Institute

12:00 - 12:30pm | Breakout Sessions

Lunch | Contesting Power with Big Tech

- Moderator: Teresa Ghilarducci, Director, Schwartz Center for Economic Policy Analysis

- Chris Hughes, Co-founder of Economic Security Project & Senior Fellow, Institute on Race, Power, and Political Economy

- Tom Smith, Senior Director for Organizing, Communications Workers of America

2:00 - 2:55pm | What Does the Modern Economy Need for Equitable Market Functioning? Market Governance Appropriate to a Democratic Nation

- Moderator: Brian Callaci, Chief Economist, Open Markets Institute

- Susan Helper, Senior Advisor for Industrial Strategy, Office of Management and Budget

- Nelson Lichtenstein, Professor in History, University of California, Santa Barbara

- David Madland, Senior Fellow, Center of American Progress

- Lenore Palladino, Assistant Professor of Economics & Public Policy, University of Massachusetts, Amherst

- Josh Tzuker, Chief of Staff, Department of Justice Antitrust Division

3:00 - 3:30pm | Breakout Sessions

4:00pm | Keynote | Rethinking Antitrust

- Elizabeth Wilkins, Chief of Staff and Director of the Office of Policy Planning, Federal Trade Commission

America’s Retirement Divide

How Black and Hispanic workers fall through the cracks

The connection between work and retirement is a two-way street. Bad jobs lead to bad retirements, but retirement insecurity also forces older workers to accept bad jobs.

The challenges facing older workers and those facing retirees are often considered separately, but EPI and SCEPA’s Older Workers and Retirement Chartbook connects the dots.

This event served as an occasion for the release of the Chartbook and focused on the challenges facing Black and Hispanic workers in preparing for retirement. Acting Social Security Commissioner Kilolo Kijakazi kicked off the discussion with an overview of Social Security’s importance to Black and Hispanic Americans. This was followed by a panel discussion of how the employer-based retirement system poorly serves workers of color, amplifying employment disparities.

Participants:

Kilolo Kijakazi, Acting Commissioner, Social Security Administration

Siavash Radpour, Associate Research Director, ReLab at the Schwartz Center for Economic Policy Analysis

Tracey Gronniger, Directing Attorney, Economic Security Team, Justice in Aging

Nari Rhee, Director of the Retirement Security Program, UC Berkeley Labor Center

Ismael Cid-Martinez, Senior Policy Analyst, Joint Economic Committee

Valerie Wilson, Director, EPI Program on Race, Ethnicity, and the Economy

EPI President Heidi Shierholz gave introductory remarks and RRF Foundation for Aging’s Program Consultant Naomi Stanhaus gave closing remarks. Teresa Ghilarducci, Bernard L. and Irene Schwartz Professor of Economics and Director, Schwartz Center for Economic Policy Analysis, moderated the panel.

Research Workshop: New Perspectives on Climate Economics

SCEPA's Economics of Climate Change project — directed by Professor Willi Semmler — held a workshop on Tuesday, October 25th on the macroeconomic analysis of trends in climate change and climate disasters. The role of the financial market was explored, as were policy efforts in mitigation and adaptation and the distributional effects of climate policies and industrial, fiscal, and monetary policies.

The plenary speaker was Paul de Grauwe, the John Paulson Chair in European Political Economy at the London School of Economics, who discussed where the U.S. and E.U. stand in terms of energy transition and the suitable macro (monetary and fiscal) policy instruments in the short and long run.

Other discussion topics included:

What are the obstacles for green investments in addition to rising energy prices and interest rates?

What are the possible effects of the fossil fuel embargo? To what extent can energy independence be achieved, given the constraints on the resource side?

What is the role of the public sector in this energy transition, and how should it interact with the private economic sector? What policies could support a just and fair transition?

How might an eventual economic crisis interact with an energy crisis, and how might the E.U. fare differently than the U.S?

Agenda:

Introductory Remarks | Professor Willi Semmler

(See presentation here.)

Session 1 | Dynamic Macroeconomics: 9:00 – 10:30am

Moderator: Oriol Vallès Codina

Julia Puashunder (9:10 – 9:30): Resilience Finance: The Role of Diversity, Hope, and Science Diplomacy (See presentation here.)

Gabriel Padró Rosario (9:30 – 9:50): Endogenous Economic Resilience, Loss of Resilience, Persistent Cycles, Multiple Attractors, and Disruptive Contractions

Jose Bastos Neves (9:50-10:10): A Credit Flow Macro Model with Nonlinear Phillips Curve: Economic Scenarios for the Pandemic Recovery Under Monetary Tightening (See presentation here.)

Ibrahim Tahri (10:10-10:30): Sustainable Investment under Inflation and Interest Rate Risk

Session 2 | Financial Markets and Climate Change: 10:30 – 11:10am

Welcome remarks by the Dept Chair Professor Sanjay Reddy

Professor Hans Helmut Kotz (Harvard University, former Board Member of the Bundesbank): Financial Market as a Roadblock or Bridge to Climate Protection?

Session 3 | Climate Change and Green Transition: 11:10 – 1:30 pm

Moderator: Jose Bastos Neves

Andreas Lichtenberger (11:10 -11:30): Fighting climate change on the back of low-income households? An analysis of the redistributive effects of the quasi-experimental policy of a revenue recycling carbon tax in British Columbia. (See presentation here.)

Amit Roy (11:30-11:50): Effect of Carbon Tax on Economy and Emission: Revisiting Fiscal Policy in Regime Switching Model.

Ettore Gallo (11:50 - 12:10): Reduction of CO2 Emissions, Climate Damage and the Persistence of Business Cycles: A Model of (De)coupling. (See presentation here.)

Behnaz Minooei Fard (12:10 - 12:30): Limit pricing and entry game of renewable energy firms into the energy sector.

Feridoon Koohi-Kamali (12:30-12:50) - Climate Change and Water Crisis. (See presentation here.)

Francesco Lucidi (12:50-1:10) - The macroeconomic effects of temperature shocks in Europe.

Damien Parker (1:10-1:30) - Monetary policy and wealth distribution (with some remarks by Jose Bastos and Willi Semmler on the proposal of a carbon wealth tax) (See presentation here.)

Lunch Break | 1:30 – 2:00pm

Session 4 | Plenary Speaker: Professor Paul de Grauwe (LSE): 2:00 pm – 3:00 pm

Moderator: Professor Willi Semmler (NSSR) (See presentation here.)

Session 5: Central Banks and Climate Change: 3:00 – 3:50pm

João Braga (3:00-3:20) - Central Banks and Climate Change (See presentation here.)

Dr. Jerome Henry, ECB (Principal Advisor) (3:20-3:40) - ECB Policy and Climate Change (See presentation here.)

Discussion

Closing remarks | 3:50pm

NSSR Economics Seminars: Narendar Pani

The Political Economy of Aging (PEoA) seminar series brings together a community of researchers in curated groups to share and discuss their research on retirement and the labor market conditions of older workers.

Our Summer & Fall 2022 schedule:

June 8 - Dr. Janina Söhn (Sociological Research Institute at University of Göttingen) - "The role of (older) age for horizontal and vertical occupational mobility: the German case"

July 6 - Dr. Carlos Madeira (Central Bank of Chile) - "The impact of the Chilean pension withdrawals during the Covid pandemic on the future savings rate"

September 29 - Dr. David Neumark (University of California-Irvine) - "Help really wanted? The impact of age stereotypes in job ads on applications from older workers"

October 18 - Dr. Carl Van Horn (Edward J. Bloustein School of Planning and Public Policy and the John J. Heldrich Center for Workforce Development at Rutgers University) - "New Start Career Network (NSCN)"

November 15 - Dr. Peter Berg (Michigan State University) - "The Role of Collective Voice in Organizational Responses to Workforce Aging"

Past participants have included:

Elsa Fornero, Università di Torino

Kenneth Couch, University of Connecticut

Na Yin, Baruch College CUNY

Edward Wolff, New York University

Mauricio DeSoto, World Bank

Lauren Schmitz, University of Michigan

Lily Batchelder, New York University

Bingwen Zheng, Graduate School of the Chinese Academy of Social Sciences

Charles Jeszeck and Sharon Hermes, the U.S. Government Accountability Office

Steven Goss, Social Security Administration

Joelle Abramowitz, Survey Research Center, Institute for Social Research, University of Michigan

Richard Johnson, Urban Institute

Courtney Coile, Wellesley College

Leora Friedberg, University of Virginia

Steven Allen, North Carolina State University

Kevin Cahill, ECONorthwest, Center on Aging & Work at Boston College

If you would like more information on the series, please contact Siavash Radpour, SCEPA's Associate Research Director, at SRadpour@newschool.edu.

NSSR Economics Seminars: Thomas Piketty

Prof Piketty from EHESS/ Paris School of Economics will present his latest book A Brief History of Equality.

In his latest book, Piketty guides us with elegance and concision through the great movements that have made the modern world for better and worse: the growth of capitalism, revolutions, imperialism, slavery, wars, and the building of the welfare state.

The Steel Miller's Daughter: Love in a Changing Climate

This modern adaptation of Franz Schubert’s The Miller's Daughter is a one-hour series of video vignettes that reimagine the classic musical story through the lens of global warming and climate disasters. The story follows a steel worker's pursuit of his boss' "green-movement" daughter against the backdrop of the mill towns of Pennsylvania.

Economics Seminar: Mariana Mazzucato

An NSSR Economics Alumna and Professor of Economics of Innovation and Public Value at the University College in London, Dr. Mazzucato presented her talk on "Directing Economic Growth: a mission-oriented approach". This lecture made the case for rethinking the role of government in the economy so that it is better equipped to deal with the greatest challenges of our times—health pandemics, climate change and the digital divide. It drew on Professor Mazzucato's recent widely acclaimed book, Mission Economy: a moonshot guide to changing capitalism, and focus on the need to move away from a reactive market fixing approach to a market shaping one. The lecture gave examples on the ‘how’: from ‘outcomes’ based budgeting, to redesigning procurement to nurture bottom up solutions, to a new symbiotic (versus parasitic) partnerships between the public and private sectors—walking the talk of stakeholder value.

Economics Seminar Series: James K Galbraith

Professor James K Galbraith from The University of Texas at Austin, presented "What's Left of Cambridge Economics?" "Cambridge Economics" as it existed from the 1930s to the 1970s attempted to forge an integrate body of theory and policy rooted in Keynes's General Theory but extending over a wide range of issues including market power, industrial organization, and income distribution -- all of which were arrogated to the domain of microeconomics by the neoclassical synthesis that emerged, largely for political reasons, from Cambridge Massachusetts in the post-war era. Meanwhile, the deficiencies of the original neoclassical vision have given rise to a great many variations and departures that nevertheless treat the original analysis of competitive general equilibrium as an ideal-type, rediscovering many of the Cambridge Keynesian insights but without embedding them in a coherent structure. The lecture will present an integrated conceptual approach to the global economy -- a global economics without distinction between "macro" and "micro" as the point of departure for analysis of core current problems, including inequality, instability, pandemic and war.

Economics Seminar Series: Laura Carvalho

Dr. Laura Carvalho, Associate Professor at Sao Paulo University, presented her paper "Effects of Fiscal Consolidation Episodes on Inequality: Narrative Evidence from South America".

This paper estimates the effect of fiscal consolidations on income inequality in nine South American economies. Results suggest that fiscal consolidations lead to a rise in income inequality. Spending-based fiscal consolidations appear to significantly increase inequality, while tax-based fiscal consolidations do not show statistically significant effects.

Dr. Carvalho graduated from NSSR Economics, obtaining her PhD in Economics in '12 and is a SCEPA Senior Fellow.

A Green Recovery from the Pandemic Meltdown

What climate policies must be part of the global Covid-19 recovery plans to ensure better pathways to a low carbon economy?

Despite slight decreases in carbon emissions at the start of Covid-19 lockdowns, the United Nations reports temperatures will still rise, threatening global goals to reduce warming below 1.5°C. There is still time to reverse course, but bold climate action is required. In particular, as a forthcoming World Bank report by a SCEPA team suggests, fiscal and monetary policies are needed to move forward to support climate protection.

SCEPA's Economics of Climate Change project, directed by Willi Semmler, panel discussion on May 6, 2021, discussed what new climate policies must be part of the global Covid-19 recovery plans to ensure better pathways to a low carbon economy

Experts from the International Monetary Fund (IMF), the World Bank, and the Observatoire français des conjonctures économiques (OFCE), the French Economic Observatory, and the London School of Economics analyzed to what extent current climate policies, such as a carbon tax, are insufficient for climate protection, whether the financial market is a roadblock or bridge to a greener economy, and which monetary and fiscal policies would further the green transition while keeping sovereign debt sustainable. Following the speakers' remarks, the audience engaged in a lively Q&A with the panelists.

Professor Willi Semmler moderated the event with welcoming remarks by Dean of The New School for Social Research William Milberg. SCEPA thanks the Thyssen Foundation for its continued support of the Economics of Climate Change project.

Speakers

Nicoletta Batini currently serves as Lead Evaluator of the International Monetary Fund’s (IMF) Independent Evaluation Office. She is an Italian economist, notable as a scholar of innovative monetary and fiscal policy practices. She pioneered work on the dangers of fiscal austerity and on how to curb debt successfully during financial deleveraging. Prior to the IMF, she was Advisor of the Bank of England’s Monetary Policy Committee, Professor of Economics at the University of Surrey, and Director of the International Economics and Policy Office of the Treasury in Italy. She holds a Ph.D. in international finance (Scuola Superiore S. Anna) and a Ph.D. in monetary economics (University of Oxford). Her work is on the macroeconomic links between private and public debt. Batini is currently researching economic policy reforms to make the agri-food sector sustainable. Her new book “The Economics of Sustainable Food: Smart Policies for People and the Planet” is out now.

View Nicoletta's presentation

Professor Paul De Grauwe is the John Paulson Chair in European Political Economy at the London School of Economics. Prior to joining LSE, Paul De Grauwe was Professor of International Economics at the University of Leuven, Belgium. He was a member of the Belgian parliament from 1991 to 2003. He is honorary doctor of the University of Sankt Gallen (Switzerland), of the University of Turku (Finland), the University of Genoa, the University of Valencia and Maastricht University. His research interests are international monetary relations, monetary integration, theory and empirical analysis of the foreign-exchange markets, and open-economy macroeconomics. His published books include "The Economics of Monetary Union" (Oxford) which was translated in ten languages and is now in its 12th edition. His other books include "International Money. Post-war Trends and Theories" (Oxford) and "The Exchange Rate in a Behavioural Finance Framework" (Princeton) and more.

Twitter: @pdegrauwe

View Paul's presentation

Dirk Heine is a Senior Economist at the World Bank whose specialties include Macroeconomics, Trade and Investment Global Practice. At the World Bank, Dirk advises Finance Ministries in 30 countries on integrating climate considerations into fiscal policy. He co-authored the first two publications on environmental issues winning the IMF Management Award and the World Bank Vice President Award for Economics, Finance and Institutions. He has been active in the environmental community since 1998 and worked as a general tax economist in the German Finance Ministry. Prior to joining the World Bank, Dirk was a Visitor at the New School. He holds a PhD in environmental taxation (summa cum laude) from the University of Hamburg.

View Dirk's presentation

Francesco Saraceno is the Deputy Director at the OFCE in Paris. He holds Ph.Ds in Economics from Columbia University and La Sapienza University of Rome. His main research interests include the relationship between inequality and macroeconomic performance, European macroeconomic policies, and the interaction between structural reforms, fiscal and monetary policies. He published in several international journals such as Journal of Public Economic Theory, Journal of Economic Behavior and Organization, and many more. In 2000 he became a member of the Council of Economic Advisors for the Italian Prime Minister's Office. In 2002 he moved to Paris to work at OFCE, the Research Center in Economics of Sciences-Po Paris. He is in charge of the Economics concentration of the Master of European Affairs at Sciences-Po, where he teaches international and European macroeconomics. He also teaches at the Master of Public Affairs, and is Academic Director of the Sciences Po-Northwestern European Affairs Program. He is a member of the Scientific Board for the LUISS School of European Political Economy (SEP), where he also teaches European macroeconomics.

Twitter: @fsaraceno

View Francesco's presentation

Climate Change & Macroeconomics: New Perspectives on Climate Economics

SCEPA's Economics of Climate Change project — directed by Professor Willi Semmler — held a workshop on Tuesday, October 25th on the macroeconomic analysis of trends in climate change and climate disasters. The role of the financial market was explored, as were policy efforts in mitigation and adaptation and the distributional effects of climate policies and industrial, fiscal, and monetary policies.

The plenary speaker was Paul de Grauwe, the John Paulson Chair in European Political Economy at the London School of Economics, who discussed where the U.S. and E.U. stand in terms of energy transition and the suitable macro (monetary and fiscal) policy instruments in the short and long run.

Other discussion topics included:

What are the obstacles for green investments in addition to rising energy prices and interest rates?

What are the possible effects of the fossil fuel embargo? To what extent can energy independence be achieved, given the constraints on the resource side?

What is the role of the public sector in this energy transition, and how should it interact with the private economic sector? What policies could support a just and fair transition?

How might an eventual economic crisis interact with an energy crisis, and how might the E.U. fare differently than the U.S?

Agenda:

Introductory Remarks | Professor Willi Semmler

(See presentation here.)

Session 1 | Dynamic Macroeconomics: 9:00 – 10:30am

Moderator: Oriol Vallès Codina

Julia Puashunder (9:10 – 9:30): Resilience Finance: The Role of Diversity, Hope, and Science Diplomacy (See presentation here.)

Gabriel Padró Rosario (9:30 – 9:50): Endogenous Economic Resilience, Loss of Resilience, Persistent Cycles, Multiple Attractors, and Disruptive Contractions

Jose Bastos Neves (9:50-10:10): A Credit Flow Macro Model with Nonlinear Phillips Curve: Economic Scenarios for the Pandemic Recovery Under Monetary Tightening (See presentation here.)

Ibrahim Tahri (10:10-10:30): Sustainable Investment under Inflation and Interest Rate Risk

Session 2 | Financial Markets and Climate Change: 10:30 – 11:10am

Welcome remarks by the Dept Chair Professor Sanjay Reddy

Professor Hans Helmut Kotz (Harvard University, former Board Member of the Bundesbank): Financial Market as a Roadblock or Bridge to Climate Protection?

Session 3 | Climate Change and Green Transition: 11:10 – 1:30 pm

Moderator: Jose Bastos Neves

Andreas Lichtenberger (11:10 -11:30): Fighting climate change on the back of low-income households? An analysis of the redistributive effects of the quasi-experimental policy of a revenue recycling carbon tax in British Columbia. (See presentation here.)

Amit Roy (11:30-11:50): Effect of Carbon Tax on Economy and Emission: Revisiting Fiscal Policy in Regime Switching Model.

Ettore Gallo (11:50 - 12:10): Reduction of CO2 Emissions, Climate Damage and the Persistence of Business Cycles: A Model of (De)coupling. (See presentation here.)

Behnaz Minooei Fard (12:10 - 12:30): Limit pricing and entry game of renewable energy firms into the energy sector.

Feridoon Koohi-Kamali (12:30-12:50) - Climate Change and Water Crisis. (See presentation here.)

Francesco Lucidi (12:50-1:10) - The macroeconomic effects of temperature shocks in Europe.

Damien Parker (1:10-1:30) - Monetary policy and wealth distribution (with some remarks by Jose Bastos and Willi Semmler on the proposal of a carbon wealth tax) (See presentation here.)

Lunch Break | 1:30 – 2:00pm

Session 4 | Plenary Speaker: Professor Paul de Grauwe (LSE): 2:00 pm – 3:00 pm

Moderator: Professor Willi Semmler (NSSR) (See presentation here.)

Session 5: Central Banks and Climate Change: 3:00 – 3:50pm

João Braga (3:00-3:20) - Central Banks and Climate Change (See presentation here.)

Dr. Jerome Henry, ECB (Principal Advisor) (3:20-3:40) - ECB Policy and Climate Change (See presentation here.)

Discussion

Closing remarks | 3:50pm

The Future of Heterodox Economics

To celebrate our 25th Anniversary, SCEPA was proud to host a discussion of how heterodox economics can build an alternative framework and policy agenda for shared prosperity, greater social equality, and a sustainable planet, while avoiding past errors.

As The New School’s Schwartz Center for Economic Policy Research (SCEPA) celebrates its 25th year, SCEPA hosted top heterodox economists for a discussion on where we can find hope for providing an alternative to neoclassical mainstream economics, both in the academy and in policy on March 11th, 2021.

Read the working paper that inspired the talk here.

In the midst of the pandemic recession and the economic devastation it has wrought from families to cities, policy makers have turned to economists for solutions. But mainstream economics failed to identify the warning signs of the financial crisis of 2007-2008 and the subsequent Great Recession. And it has yet to offer an equitable solution to the ongoing recession. In fact, the dominance of the current paradigm in the education and practice of economics over the last 40 years has coincided with a historic rise in inequality and stagnant wages and ongoing racial injustice and climate change.

Clearly mainstream economics is not equipped to generate more just and secure economic outcomes. But in spite of its failure, little has changed in the way economists think about markets and states or how economics is taught in the majority of academic institutions.

Alternatives exist in the teaching and practice of “heterodox” economics -- a diverse set of schools of thought including feminist economics, post-Keynesianism, and neo-Marxism built on insights from economist such as Marx, Keynes, Robinson, and Sen. Yet, these traditions have been sidelined in most university economics departments and often receive little attention from policy makers.

Speakers

Stephanie Kelton is an economist, academic, and author of The Deficit Myth: Modern Monetary Theory and the Birth of the People's Economy. She is currently a SCEPA Senior Fellow and a Professor at Stony Brook University. Professor Kelton has served as Chief Economist on the U.S. Senate Budget Committee (Democratic staff) and as an advisor to Bernie Sanders' 2016 presidential campaign. She is founder and editor-in-chief of the blog New Economic Perspectives and she was named one of Politico's 50 "thinkers, doers and visionaries transforming American politics in 2016." She has been a notable proponent of and researcher in Modern Monetary Theory, publishing several papers and editing books in the field, and a supporter of the proposal for a Job Guarantee.

Deirdre Nansen McCloskey is Distinguished Professor Emerita of Economics and of History, and Professor Emerita of English and of Communication, at the University of Illinois at Chicago. Trained at Harvard in the 1960s as an economist, she has written twenty books and some four hundred academic articles on economic theory, economic history, philosophy, rhetoric, statistical theory, feminism, ethics, and law. She taught for twelve years at the University of Chicago in the Economics Department, but now describes herself as a “literary, quantitative, postmodern, free-market, progressive-Episcopalian, ex-Marxist, Midwestern woman from Boston who was once a man. Not ‘conservative’! I’m a Christian classical liberal.”

Anwar Shaikh is Professor of Economics at the New School for Social Research and Senior Scholar and member of the Macro Modeling Team at the Levy Economics Institute of Bard College. He has written in a variety of areas, including international trade, finance theory, political economy, U.S. macroeconomic policy, growth theory, inflation theory, and crisis theory. He is the author of Capitalism: Competition, Conflict, Crises. He is also an Associate Editor of the Cambridge Journal of Economics. Shaikh earned his PhD from Columbia University in 1973 and has been teaching at the New School since 1972.

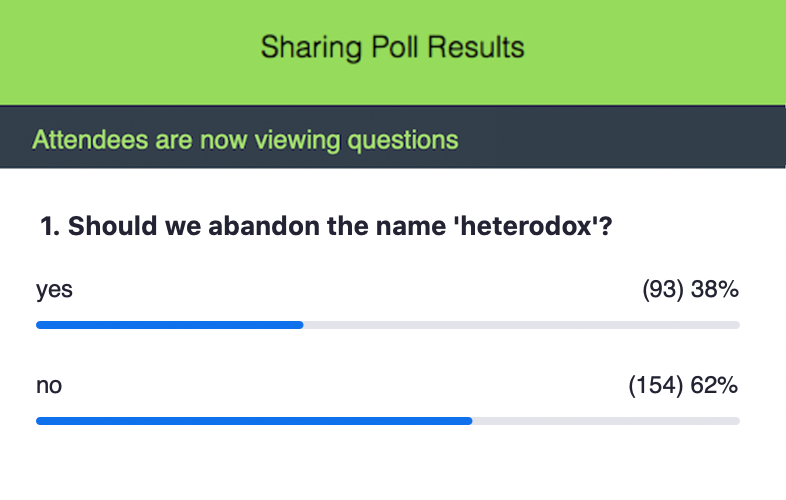

The speakers' remarks were followed by thoughts from a PhD student in the Department of Economics at the New School for Social Research, Gustavo Pereira Serra. See his full comments here. The event also asked attendees to vote on whether or not the term 'heterodox' should be abandoned. We are excited to share the results of that poll here.

Older Workers & COVID-19: The Harsh Economic Realities

Kilolo Kijakazi is an Institute fellow at the Urban Institute developing partnerships with those most affected by economic and social issues, effectively communicating findings to diverse audiences, and recruiting a diverse research staff at all levels. Kijakazi also conducts research on economic security, structural racism, and the racial wealth gap. Previously, Kijakazi was a program officer at the Ford Foundation, focusing on economic security and incorporating the expertise of people of color into all aspects of the work. She was a member of the Bipartisan Commission on Retirement Security and Personal Savings, a senior policy analyst for the Center on Budget and Policy Priorities, and a policy analyst for the National Urban League. She is a board member of the National Academy of Social Insurance and a cochair of the National Advisory Council on Eliminating the Black-White Wealth Gap, among many other appointments.

Monique Morrissey, Economic Policy Institute

Monique Morrissey is an Economist at the Economic Policy Institute (EPI). Her areas of interest include Social Security, pensions and other employee benefits, household savings, tax expenditures, older workers, public employees, unions, and collective bargaining, Medicare. She is active in coalition efforts to reform the private retirement system to ensure an adequate, secure, and affordable retirement for all workers. She is a member of the National Academy of Social Insurance. Prior to joining EPI, Morrissey worked at the AFL-CIO Office of Investment and the Financial Markets Center.

Richard Johnson, The Urban Institute

Richard W. Johnson is a senior fellow in the Income and Benefits Policy Center at the Urban Institute, where he directs the Program on Retirement Policy. His current research focuses on older Americans’ employment and retirement decisions, long-term services and supports for older adults with disabilities, and state and local pensions. Recent studies have examined job loss at older ages, occupational change after age 50, employment prospects for African Americans and Hispanics over age 50, and the impact of the 2007–09 recession and its aftermath on older workers and future retirement incomes. He has also written extensively about retirement preparedness, including the financial and health risks people face as they approach retirement, economic hardship in the years before Social Security's early eligibility age, and the adequacy of the disability safety net.

Teresa Ghilarducci, ReLab at The New School

Teresa Ghilarducci is a labor economist and nationally-recognized expert in retirement security. She holds the Irene and Bernard L. Schwartz Chair in economic policy analysis in the Economics Department at the New School for Social Research and directs the Schwartz Center for Economic Policy Analysis (SCEPA) that focuses on economic policy research and outreach. She is also a Research Associate at the Economic Policy Institute (EPI). Ghilarducci was professor of economics at the University of Notre Dame for 25 years prior to joining The New School. Currently she serves as a trustee for two retiree health care trusts: one for the United Auto Worker (UAW) retirees at GM, Ford, and Chrysler, and the other for Steelworker retirees at Goodyear. She was twice appointed by President Clinton to serve on the Pension Benefit Guaranty Corporation advisory board. Her most recent book, Rescuing Retirement: A Plan to Guarantee Retirement Security for All Americans, offers solutions to the growing retirement crisis in the U.S.

Think & Drink @ Home: COVID 19 and Its Impact on the Economy

On Wednesday April 8, 2020 Teresa Ghilarducci — Bernard L. and Irene Schwartz Professor of Economics and Director of the Schwartz Center for Economic Policy Analysis— and Mark Setterfield —Professor and Chair of Economics at The New School for Social Research—had a virtual discussion about the economic impact of the COVID-19 coronavirus. You can read Professor Ghilarducci's presentation here.

Coordination and Externalities in Classical Growth Models

Daniele Tavani, Associate Professor at Colorado State University, will present his paper, "Coordination and Externalities in Classical Growth Models".

Date: Feb. 25, 2020

Time: 4-6PM

Location: The New School, 6 East 16th Street, Room D 1009

The event is part of the Fall 2020 Seminar Series hosted by The New School Economics Department. The seminar series features lectures, paper and book presentations from prominent economists.

Heather Boushey, Unbound: How Inequality Constricts Our Economy

SCEPA was pleased to welcome economist and New School PhD Heather Boushey for a discussion on how inequality undermines economic growth—the topic of her latest book, Unbound: How Inequality Constricts Our Economy and What We Can Do About It.

The event began with a presentation by Dr. Boushey summarizing the findings in her book, Unbound. Based on Dr. Boushey's research (with the help of her team at The Washington Center For Equitable Growth), she showed three main ways inequality constricts our economy: first by obstructing ideas and access to the economy, next by subverting and manipulating the government institutions regulating the market, and last by distorting the sources of economic consumption so much so that it decreases investment in relevant products.

Monopsony power—or the increasing concentration of the economy into a small number of companies—and the effective erasure of unions (and their collective bargaining power) were highlighted as two of the many reasons why workers have had less power over the past 40 years than earlier generations to decrease this inequality. However, Dr. Boushey's most urgent recommendation is to push policymakers to measure GDP differently, to stop releasing GDP numbers alone and instead release them with contextualized numbers on where the country's economic growth is going.

Two New School economics students, Tracey Freiberg and Remzi Tercioglu, responded to Heather's presentation. Tracey focused on how companies keep wages low and inequality high, by offering benefits to workers that they are effectively barred from using, such as paid family leave, through shaming and other methods. And Remzi showed how we can expose our inflated GDP numbers by breaking the growth number out into different economic sectors, such as healthcare or financial services, where growth and tangible value is more subjective and thus harder to calculate.

David Howell closed the event with remarks about how, with time, our GDP has grown but the amount of high-quality, decent paying jobs has decreased. He used evidence from five OECD countries and concluded that France's policies were the only policies which increased the share of good paying jobs since the early 1980s. The event ended with a panel discussion and a Q&A moderated by Professor Howell.

Heather Boushey is President and CEO of the Washington Center for Equitable Growth, former Chief Economist on Hillary Clinton’s transition team, and a New School of Social Research Economics PHD. She is the author of Finding Time: The Economics of Work-Life Conflict and coeditor of After Piketty: The Agenda for Economics and Inequality.

The Aggregate and Distributional Effects of Financial Globalization

Jonathan Ostry, Deputy Director of the Research Department at the International Monetary Fund and a Research Fellow at the Center for Economic Policy Research (CEPR), will present his paper, "The Aggregate and Distributional Effects of Financial Globalization: Evidence from Macro and Sectoral Data."

Date: Feb. 18, 2020

Time: 4-6PM

Location: The New School, 6 East 16th Street, Room D 1009

The event is part of the Fall 2020 Seminar Series hosted by The New School Economics Department. The seminar series features lectures, paper and book presentations from prominent economists.

The Macroeconomics of World War II: Lessons for the Green New Deal

Josh W Mason, Assistant Professor at John Jay College, will present his latest paper, “The Macroeconomics of World War II: Lessons for the Green New Deal.”

Date: Feb. 11, 2020

Time: 4-6PM

Location: The New School, 6 East 16th Street, Room D 1009

The event is part of the Fall 2020 Seminar Series hosted by The New School Economics Department. The seminar series features lectures, paper and book presentations from prominent economists.