How Student Debt Impedes Retirement and Financial Security for Older Workers—And How 2024 Elections May Impact Policy Reforms

RELAB POLICY NOTE

How are older debtors and their retirement savings impacted by student loans? Our analysis of the data shows that millions of older workers in the U.S. have significant student debt that may hinder their ability to retire comfortably.

Key Findings:

- There are 2.2 million people over the age of 55 with outstanding student loans.

- Older workers aged 55 and up in middle-income brackets represent the highest proportion of all student loan borrowers (43%).

- This student debt hinders older debtors’ ability to retire and save for retirement.

- Policy interventions can mitigate these impacts by forgiving student debt, making debt repayment easier, and by preventing the garnishing of Social Security benefits to repay student loans.

Student debt is not only a problem for young people – these debt burdens plague millions of older debtors aged 55 and up. This elder student debt raises the risk that older people will not have adequate retirement income and may require public assistance. Since older debtors have less time to use their education in the workforce, their earnings returns are lower than for young debtors. Paying back student debt obligations inhibits retirement savings and voluntary retirement. Policies to help elders with student debt include the Saving on a Valuable Education (SAVE) Plan initiated by the Biden administration (now temporarily halted by court challenges); and reducing Social Security garnishments to repay federal student loans.

Student loans can equalize access to opportunity and financial mobility by enabling students without wealthy parents or other finances to afford college.

Experts stress that student loans are personal investments2 that increase individual lifetime earnings and wealth.3 While some younger workers may get access to opportunity and upward mobility by borrowing money for school,4 the estimated 2.2 million people over the age of 55 with outstanding student loans are unlikely to increase their lifetime wealth, because they have less time to earn and pay off their loan. Instead, the debt keeps them working past the age of planned retirement and inhibits saving for retirement. Compounding these effects, over 14 percent of older debtors have not completed their degree and thus fail to obtain the pay raises expected for workers with completed degrees.

Three policies would minimize the negative impacts of student debt on retirement savings: 1) student loan forgiveness; 2) income-based repayments – key components of the Saving on a Valuable Education (SAVE) Plan;5 3) preventing garnishment of Social Security benefits to repay student loans. The first two would have the strongest impact and affect people most in need.

Millions of Older Americans Saddled With Student Loan Debt

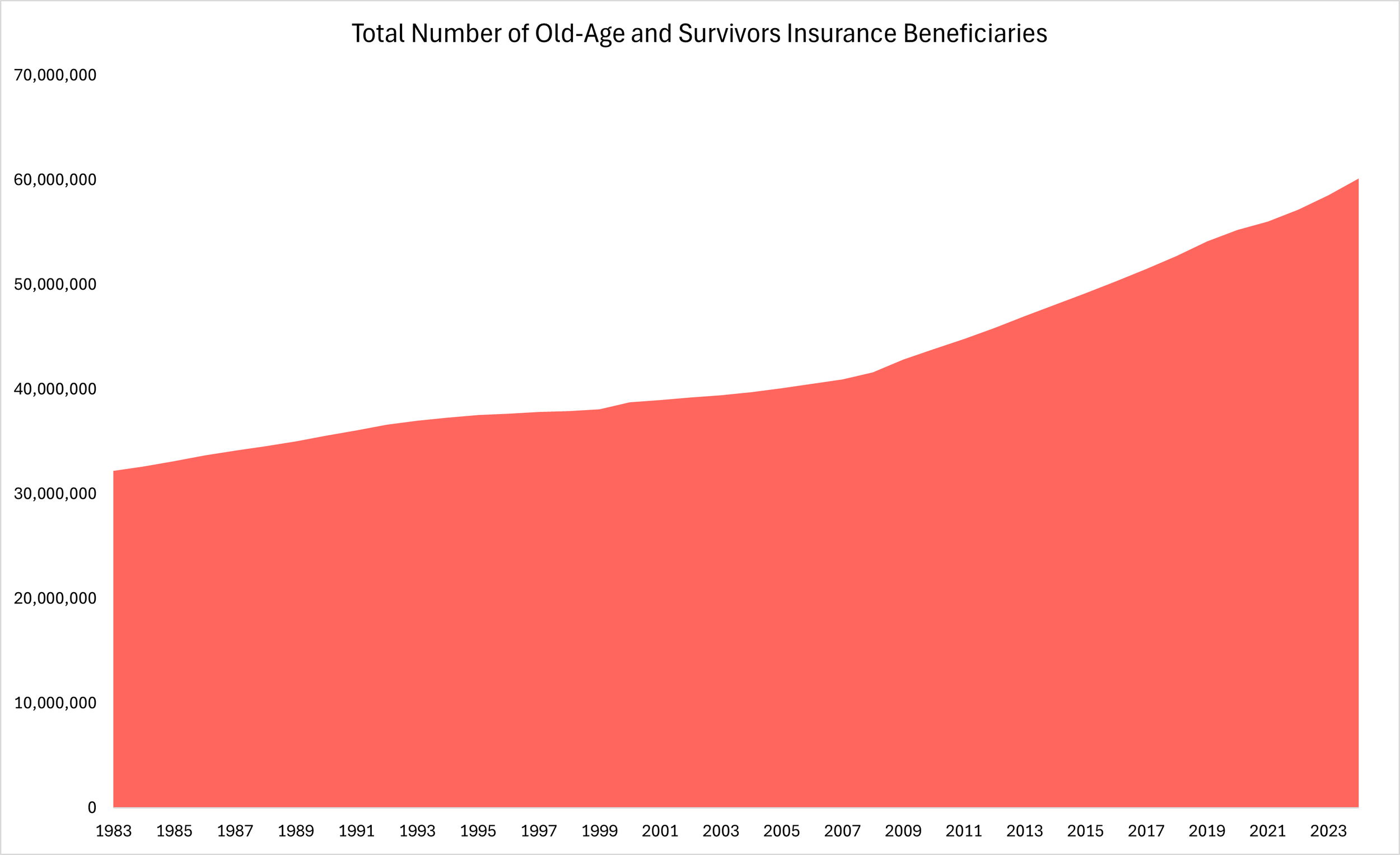

More than 1.4 million workers6 and over 820,000 unemployed people7 aged 55 and above have outstanding student loans attributed to either them or their spouses, according to data from the Federal Reserve Board’s 2022 Survey of Consumer Finance (SCF).

Figure 1 - Total Number of Older People With Loans

Source : SCEPA calculations using data from the Survey of Consumer Finances, 2022.

Older Workers Do Not Benefit From Returns to Education

Student loans are considered potentially ‘good’ debt because borrowers increase their future lifetime earnings with a college degree. But this assumes that debtors have a long working life or will significantly increase their income due to their degree, enabling them to repay their debt and recoup high returns. Older debtors do not have 20-30 years to benefit from enhanced earnings, meaning they get a far lower rate of return.

Half of all debtors over age 55 who are still in the labor force are in the bottom half of income-earners, making less than $54,600, based on estimates using 2022 SCF data. Policymakers must address this major financial vulnerability.

Figure 2 - Percentage of Older Workers (55+) With Student Debt by Class

Source: SCEPA calculations using data from the Survey of Consumer Finances, 2022.

Exacerbating these vulnerabilities, 14.9 percent of workers aged 55-64 and 17.2 percent of workers 65 and older have not completed the degree for which they’d taken out loans – so they don’t gain financially. This is comparable to the 18 percent of workers aged 25-54 who haven’t completed their degrees, meaning they have significant debt without benefiting from the expected income rise from a completed degree. This is known as the “sheepskin” effect.8 These older workers face the dual effects of indebtedness and lack of enhanced earning power, making them especially precarious.

Figure 3 - Proportion of Debtors Who Haven't Completed Their Degree

Source: SCEPA calculations using data from the Survey of Consumer Finances, 2022.

The problem of incomplete degrees is highly class-based: all debtors without completed degrees are in the bottom 90 percent income level of older workers.

Figure 4 - Proportion of Incomplete Degrees Among Older Workers (55+) by Class

Source: SCEPA calculations using data from the Survey of Consumer Finances, 2022.

Student Debt Diminishes Older Workers’ Retirement Security

Debt-burdened older workers face student loan repayment well into their retirement age years. The Survey of Consumer Finances found that older workers aged 55-64 expect to take an average of nearly 11 years (10.96) to repay their loans, while workers 65 and up will need 3.5 years to pay off their student debt, on average.

Figure 5 - Average Time (in Years) Remaining to Repay Loans

Source: SCEPA calculations using data from the Survey of Consumer Finances, 2022.

Another significant class-related concern: the bottom 50 percent of income earners owe the highest average debt ($58,823).

Figure 6 - Average Debt (USD) Still Owed By Older Workers (55+) by Class

Source: SCEPA calculations using data from the Survey of Consumer Finances, 2022.

Older workers’ substantial repayment period9 and the sizable amounts still owed10 hinder their ability to retire and save for retirement. First, the high level of debt relative to income means borrowers have high repayment burdens – the ratio of amount owed to amount earned in a given time period – which increases their risk of default.11 When a debtor defaults on a student loan, the loan becomes “delinquent.” Delinquent federal student loans are one of the few conditions which trigger Social Security benefits to be garnished12and thus reduces retirement income.

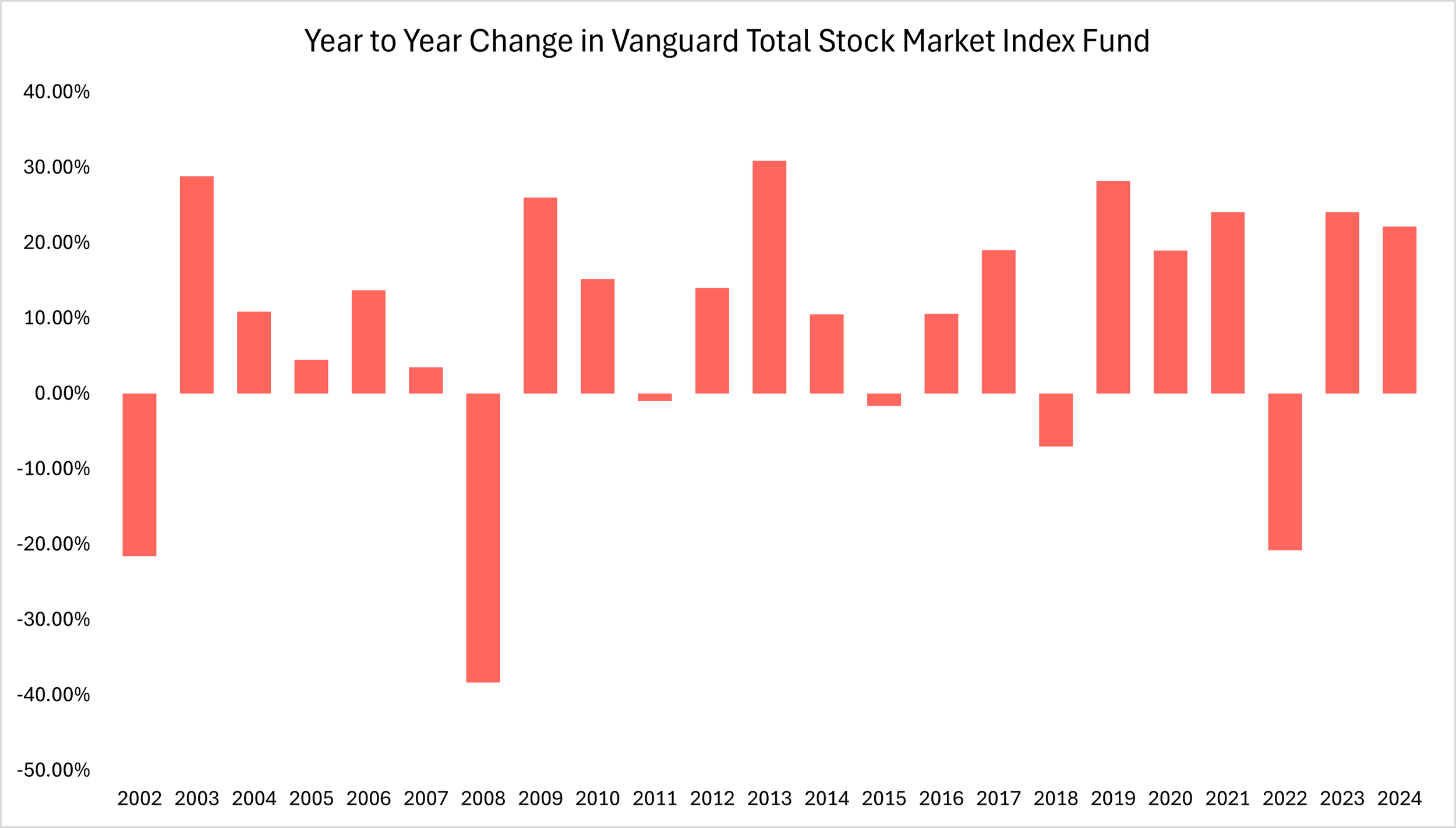

Second, student loan repayments can lower retirement savings. The need to repay student debt may delay or prevent retirement and can negatively impact workers’ retirement security.

To illustrate these impacts, consider a hypothetical older worker, Chris, who lost his job due to the 2008 financial crisis. Chris was advised to enroll in a master’s degree program at a local, non-ranked private college in order to re-skill himself and become competitive on the job market. To pursue the degree, Chris took on a combination of federal and private loans. In 2024, Chris is now 55 years old and earns the median income of $54,600. After a decade and a half of making minimum monthly repayments, he is still saddled with a debt of $50,000 at 4.3 percent interest.

In order to retire by age 65 without any student debt, Chris must repay his loan in nine years – requiring an annual repayment of $5,364, which represents an annual repayment burden of 9.9 percent, considered a “medium” level.13 At this rate, Chris loses an additional $60,386 in funds that could have otherwise gone to his retirement.

Chris could reduce his repayment burden to have more money to save for retirement by extending his loan repayment period, but this would likely delay his ability to retire. If Chris loses his job and decides to prematurely begin drawing on his Social Security benefits at age 62, but then defaults on his federal loans, he could lose about $2,500 a year in garnished Social Security benefits.xii

Key Policy Interventions: Loan Forgiveness, Income Driven Repayments, and Ending Social Security Garnishments

Three key policy interventions would enable older workers to overcome their debt burdens and save for retirement:

- Loan Forgiveness: Loan forgiveness is the most direct way to address the negative impacts of student loans on older workers. Discharging loan obligations would allow older workers to save their income for retirement, benefiting not only them but their families and communities.

- Income-Driven Repayments (IDR): Under an IDR plan, debtors would only make monthly repayments when their income rises above a certain threshold. Additionally, they would only be obligated to pay a percentage of their income at a time until their loans are repaid. Beyond a certain period conditioned on the amount borrowed, outstanding loans would be forgiven. This approach would allow low-income older debtors to save for retirement as they would only be required to repay a portion of their income.

- Ending Social Security Garnishment: In the current system, people who default on federal student debt are liable to have their Social Security benefits garnished, reducing their retirement income. Removing this provision would help protect retirees and older workers who are already financially precarious. This basic protection would help many American seniors stabilize their finances, improve their economic security, and be able to retire.

The Savings on a Valuable Education (SAVE) Plan,14 introduced by the Biden administration in 2023, provides for accelerated loan forgiveness and an income-driven repayment plan, giving older workers a path toward retirement security. The SAVE Plan’s emphasis on income-driven repayment (IDR) also alleviates the harmful impact of loans on older workers. A federal court ruling in July 2024 has stalled implementation of the SAVE Plan, and the Biden-Harris administration is challenging the ruling, which it says “would have devastating consequences for millions of student loan borrowers crushed by unaffordable monthly payments if it remains in effect.”15

In March 2024, more than 30 members of Congress called on the Social Security Administration to end the garnishing of Social Security benefits to repay federal loans – calling it “a particularly devastating practice for seniors and people with disabilities who rely on Social Security as their sole source of income.”

Older Americans already in default can also benefit from the “Fresh Start” initiative,16 a temporary measure to help defaulters adjust their accounts to reflect income-driven repayment credits from March 2020 onwards by exiting default prior to the Fresh Start deadline; reversing their default status would benefit older Americans at risk of Social Security garnishments.

1 Zhong, M., Cohn, J. and Harvey, C. (2024, July 24). “Ensuring Americans Can Retire Free from Student Loan Debt.” Urban Institute. https://www.urban.org/urban-wire/ensuring-americans-can-retire-free-student-loan-debt

2 Stedman Jones, D. (2012). Masters of the Universe: Hayek, Friedman and the Birth of Neoliberal Politics. Princeton: Princeton University Press.

3 Johnstone, D. B. (2004). The economics and politics of cost sharing in higher: comparative perspectives. Economics of Education Review, 23, 403-410.

4 Dettling, Lisa J. and Goodman, Sarena and Reber, Sarah. (August 2022). Saving and Wealth Accumulation among Student Loan Borrowers: Implications for Retirement Preparedness. Wharton Pension Research Council Working Paper No. 2022-18. Available at SSRN: https://ssrn.com/abstract=4191960 or http://dx.doi.org/10.2139/ssrn.4191960

5 United States Department of Education. (n.d.). “The Saving on a Valuable Education (SAVE) Plan Offers Lower Monthly Loan Payments. Federal Student Aid.” https://studentaid.gov/announcements-events/save-plan

6 1,009,619 workers aged 55-64; and 389,196 workers aged 65 or older.

7 518,321 people aged 55-64; and 311,629 aged 65 or older.

8 aeger, David A. and Marianne E. Page. (1996). Degrees Matter: New Evidence on Sheepskin Effects in the Returns to Education. The Review of Economics and Statistics Vol. 78, No. 4, pp. 733-740 JSTOR: 2109960

9 3.58 years for those aged 65+; and 10.96 years for those aged 55-64.

10 $58,823 for the bottom half of workers (by income) aged 55 and older.

11 Gross, J. P., Ceckik, O., Hossler, D., & Hillman, N. (2009). What Matters in Student Loan Default: A Review of the Research Literature. Journal of Student Financial Aid, 39, 19-29.

12 Wettstein, Gal and Siyan Liu. (2023). “How Do Unpaid Student Loans Impact Social Security Benefits?” Issue in Brief 23-1. Chestnut Hill, MA: Center for Retirement Research at Boston College.

13 United States Department of Education. “Student Loan Debt Burden.” Federal Student Aid. https://studentaid.gov/help-center/answers/article/student-loan-debt-burden

14 Council of Economic Advisors. (2024). Issue Brief: The Benefits of SAVE. Washington: The White House. Retrieved from https://www.whitehouse.gov/cea/written-materials/2024/02/21/issue-brief-the-benefits-of-save/

15 U.S. Department of Education. (n.d.). Department of Education Updates on Saving on a Valuable Education (SAVE Plan). www.ed.gov/save

16 U.S. Department of Education. (n.d.). Get Out of Default with Fresh Start. Federal Student Aid. https://studentaid.gov/announcements-events/default-fresh-start

17 Knott, K. (2024, July 19). Biden’s SAVE Plan Blocked by Federal Court Inside Higher Ed. https://www.insidehighered.com/news/government/student-aid-policy/2024/07/19/federal-appeals-court-halts-bidens-save-plan

18 The White House. (2024, April 08). President Joe Biden Outlines New Plans to Deliver Student Debt Relief to Over 30 Million Americans Under the Biden-Harris Administration [press release]. https://www.whitehouse.gov/briefing-room/statements-releases/2024/04/08/president-joe-biden-outlines-new-plans-to-deliver-student-debt-relief-to-over-30-million-americans-under-the-biden-harris-administration/

19 Lee, M. (2024, July 31). What Kamala Harris has said (and done) about student loans during her career. USA Today. https://www.usatoday.com/story/money/personalfinance/2024/07/31/kamala-harris-student-loans/74596869007/

20 Office of Pramila Jayapal (2023, June 14). Jayapal, Sanders Introduce Legislation to Address Student Debt Crisis [press release]. https://jayapal.house.gov/2023/06/14/jayapal-sanders-introduce-legislation-to-address-student-debt-crisis/

21 Minsky, A. (2024, July 10). “Could Trump Repeal PSLF And Other Student Loan Forgiveness Plans?” Forbes. https://www.forbes.com/sites/adamminsky/2024/07/10/could-trump-repeal-pslf-and-other-student-loan-forgiveness-plans/

22 Nova, A. (2024, July 16). “Trump VP pick Vance once called on GOP to fight student loan forgiveness ‘with every ounce of our energy.’ CNBC. https://www.cnbc.com/2024/07/16/trump-vp-vance-on-student-loan-forgiveness.html

23 Partridge, S. & Weiss, M. (2024, June 24). Project 2025 Would Increase Costs, Block Debt Cancellation for Student Loan Borrowers. Center for American Progress. https://www.americanprogress.org/article/project-2025-would-increase-costs-block-debt-cancellation-for-student-loan-borrowers/

24 The U.S. federal poverty level for an individual was $15,060 in 2024, according to the U.S. Department of Health and Human Services. For more on U.S. poverty levels, see SCEPA’s report, “Lowballing Poverty.”