Trends in Retirement Plan Access and Participation Rates

RELAB REPORT

(735 KB)

New research shows regardless of the data source, retirement plan participation is low and stagnating.

"Trends in Employer-Sponsored Retirement Plan Access and Participation Rates: Reconciling Different Data Sources," a research note from SCEPA's Retirement Equity Lab, finds that retirement plan participation is low and stagnating, regardless of the data source used. This reality is primarily due to employers choosing not to offer employees access to these plans.

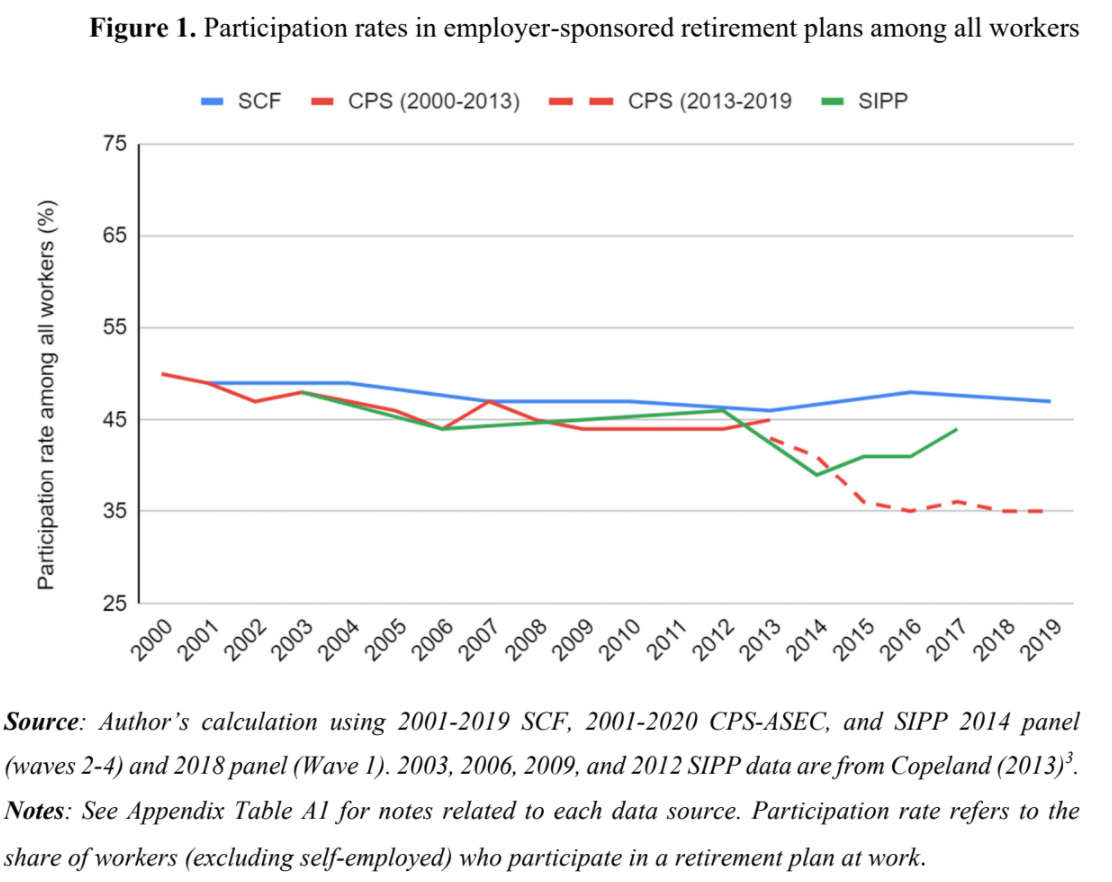

Analysts and representatives of the news media often get confused about American

workers’ retirement plan coverage due to the complexities behind multiple data sources. Namely, differing methodologies used by each source report different results. This research note updates previous attempts to explain the data differences and reports trends between 2000 and 2020 in two measures of employer-sponsored retirement plan coverage: access rate (the share of workers who are offered a retirement plan at work and are eligible to participate in them) and participationrate (the share of all workers who are participating in retirement plans offered at work). We also break down retirement plan access and participation rates by race, gender, and socio-economic status to report disparities in coverage.

Regardless of the data source used, retirement plan participation is low and stagnating, a

reality that is primarily due to employers choosing not to offer employees access to these plans. The current design of the American retirement system leaves between 53 percent and 65 percent of workers are participating in retirement plans at work. The American retirement system leaves out most workers, especially low-income workers and minorities. Retirement plan coverage is unequally distributed, with minorities and low-income workers less likely to have access to employer-sponsored retirement plans, reflecting their lack of bargaining power.