How Much Retirement Wealth and Debt Do the Middle 70% Have?

RELAB POLICY NOTE

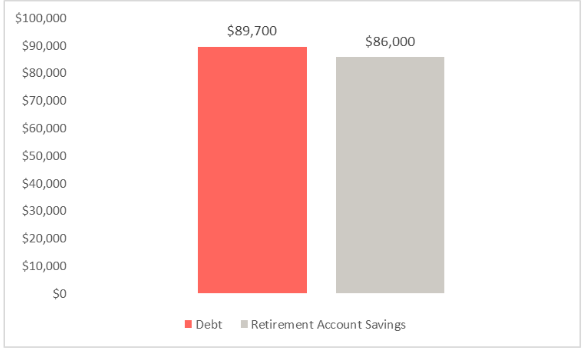

A brief analysis of the 2022 round of the Survey of Consumer Finance indicates that the middle 70% of households by income that are aged 50-65 have a median retirement account savings of $86,000, while also having a median debt of $89,700.

Median Retirement Account Savings and Debt by Age

Source: Author’s Calculations from the Survey of Consumer Finance, 2022

Note: Middle 70% is defined as households whose income lies within the 20th and 90th percentile of incomes for households aged 50-65, i.e. between $29,185 and $174,218. A household’s age is based on the age and education level of the reference person, who, in households of more than one person, is defined by the Survey of Consumer Finances as the male in a mixed-sex couple or the older person in a same-sex couple (Bhuta et al. 2020). Retirement account savings include funds in 401(k)-style defined contribution plans and in IRAs but not in defined benefit pension plans. Debt includes principal residence debt (mortgages and HELOCs), other lines of credit, debt for other residential property, credit card debt, installment loans, and other debt but does not include vehicle loans and education loans.

References:

Bhutta, Neil, Jesse Bricker, Andrew C. Chang, Lisa J. Dettling, Sarena Goodman, Joanne W. Hsu, Kevin B. Moore, Sarah Reber, Alice Henriques Volz, and Richard Windle. 2020. “Changes in U.S. Family Finances from 2016 to 2019: Evidence from the Survey of Consumer Finances.” Federal Reserve Bulletin 106, no. 5.